|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Markets

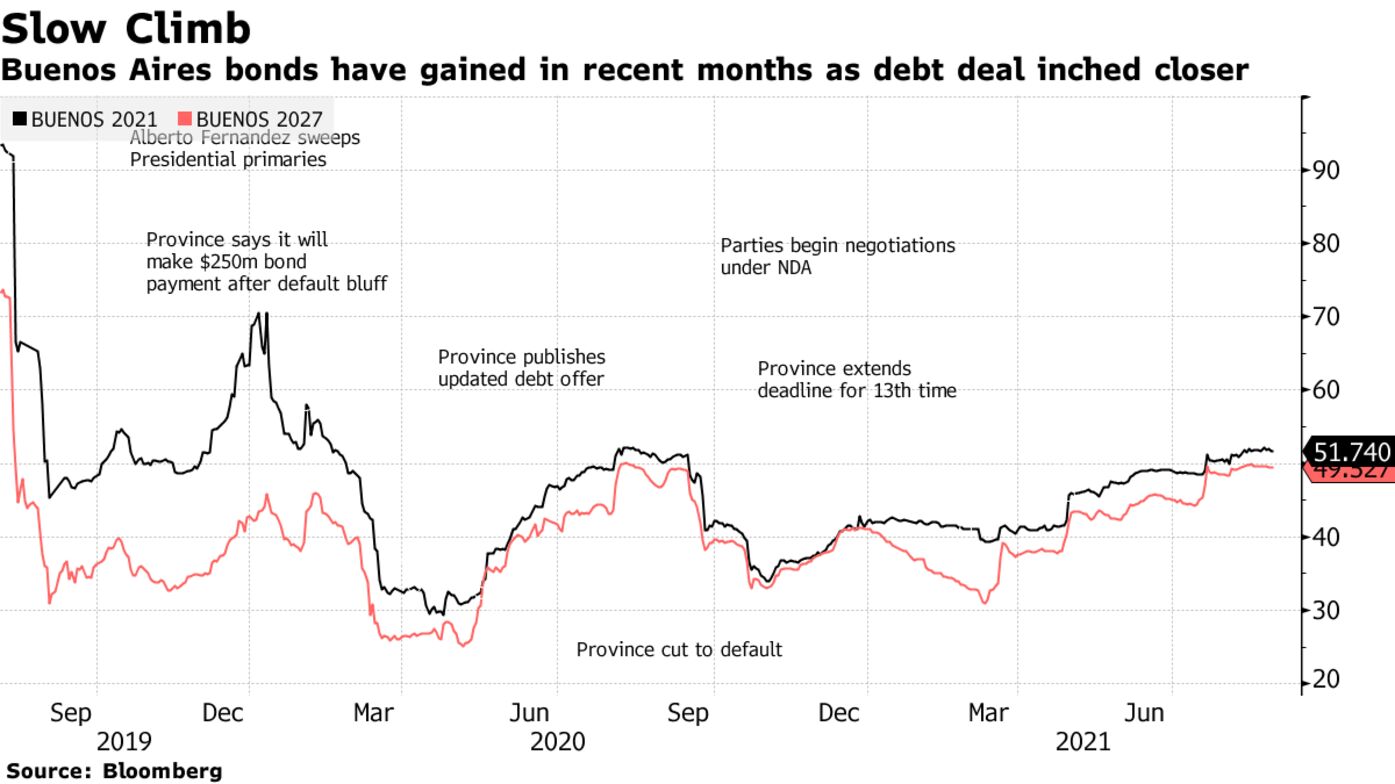

Buenos Aires won enough creditor support to restructure 98% of its $7.1 billion in overseas debt, putting Argentina’s largest and most populous province a step closer to ending a 16-month default.

The province, also the country’s wealthiest, will swap all of the bonds it had offered to exchange except for portions of dollar-denominated notes due 2021 and euro-denominated bonds due 2020, which had been issued under rules that required a higher amount of creditor participation to pull all holders along. The deal will settle Sept. 3, according to a statement.

The exchange marks a success for Buenos Aires Governor Axel Kicillof, known for butting heads with investors as Argentina’s economy minister half a decade ago, and his strategy of structuring the deal in a way designed to dissuade creditors from holding out. It also brings Argentina’s most recent round of debt restructurings nearer a close, after a sharp economic contraction exacerbated by the pandemic prompted nearly every province to restructure obligations over the past 12 months. The national government swapped $65 billion in securities a year ago.

“It’s yet another deal to kick the can down the road and give the economy time to heal and recover,” said Walter Stoepplewerth, chief investment officer at Portfolio Personal Inversiones in Buenos Aires. “It avoids nasty litigation that could have complicated the province’s access to multilateral loans.”

The accord will save the province $4.6 billion through 2027, money that can be applied to infrastructure and social spending, Buenos Aires Economy Minister Pablo Lopez said at a press conference.

The province’s new bonds mature in 2037 and are valued at about 51 cents on the dollar. Creditors who accepted the deal will also receive a 10% cash payment of interest accrued during default, and the remaining 90% will be tacked onto the bonds’ principal.

The bond deal was structured to take advantage of collective action clauses written into the bonds’ rules that can force investors to participate in the swap if enough holders vote in favor of the deal. Buenos Aires offered significantly worse terms for creditors who voted against the accord but got pulled along anyway, creating a significant incentive to vote yes.

Home to almost 18 million people and accounting for two-fifths of Argentina’s gross domestic product, Buenos Aires has been in default since April 2020. On Aug. 26 the province said it received support from holders of more than 90% of its bonds, including GoldenTree Asset Management, its largest creditor.

Lopez didn’t specify what percentage of holders of the $900 million bond due in 2021 and 95 million euro bond that matured last year declined to participate in the deal. He said regulations in some creditors’ countries might have not allowed them to participate.

“It’s still very recent, we need to analyze what happened and what the issue was,” he said.

African Eurobond Sales See Strongest Start to Year Since 2013 Pedestrians in the financial district in Nairobi. Photographer: Kang-Chun Ch...