Argentina and Ecuador – LatAm’s riskiest countries after restructuring in 2020

By Juan Pablo Álvarez

Argentina and Ecuador restructured their debts with private creditors in 2020 within the framework of the coronavirus quarantines.

They did it in a very different way.

While Guillermo Lasso’s administration took three months and did it after a previous agreement with the International Monetary Fund, Alberto Fernández’s team took more than twice as long and without a previous deal with the IMF.

This difference caused both restructurings to have divergent paths: as an example, while Argentina closed 2022 with a country risk of 2,162 units, Ecuador did the same at 1,255 basis points.

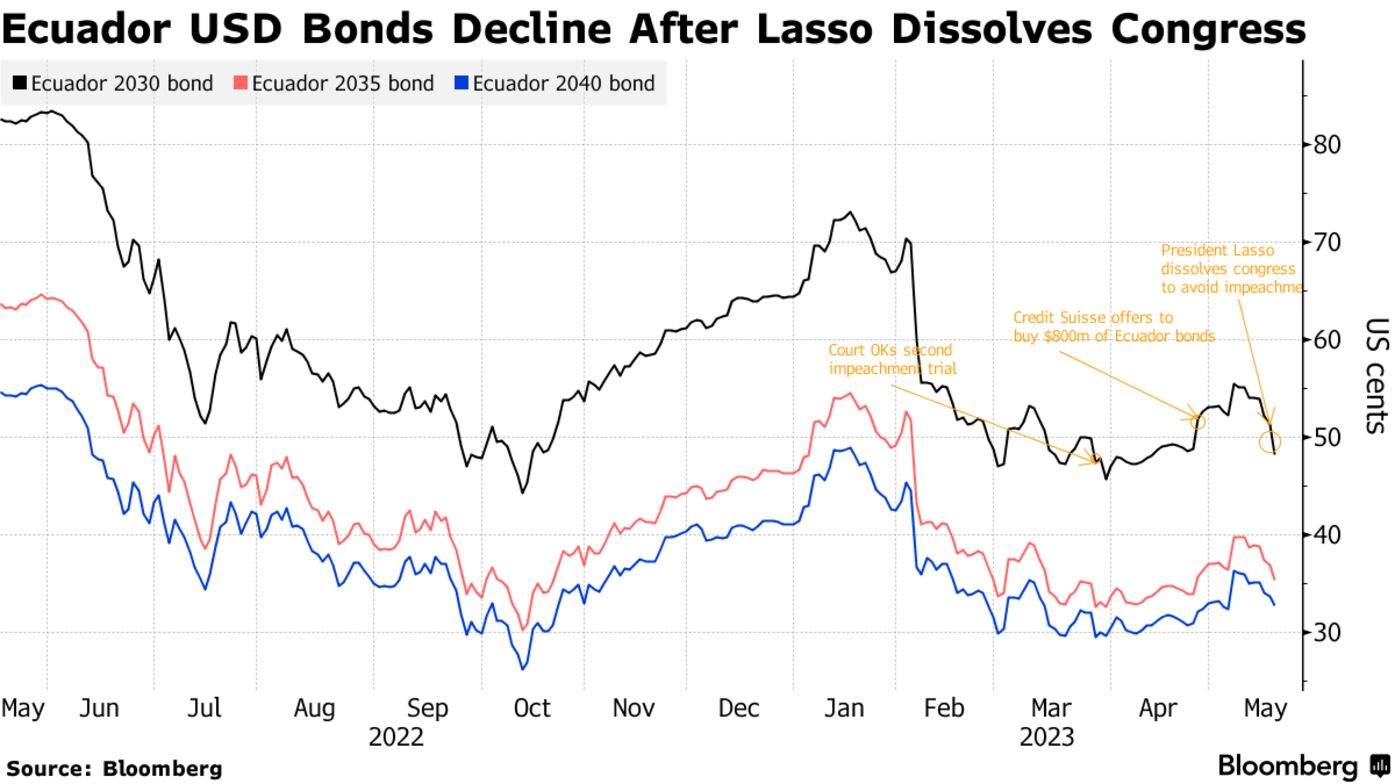

However, the political crisis faced by President Lasso in Ecuador – he has just dissolved the Assembly and called for elections for executive and legislative positions, anticipating his impeachment – severely damaged sovereign bonds and, at this moment, Ecuador’s country risk stands at 1,857 points (against 2,596 of Argentina).

Both states currently have the second and third worst country risk in Latin America since the first place is occupied by Nicolás Maduro’s Venezuela (35,587.91 units).

In this context, the Argentine consulting firm Quantum Finanzas prepared a study on the evolution of both debt restructurings.

THIS IS HOW ARGENTINA’S AND ECUADOR’S DEBTS EVOLVED

The average price of Ecuador’s sovereign debt in dollars is 40/100, while Argentina’s is 26.5/100 (Global bonds).

“The recent sharp correction in the price of Ecuador’s (from almost 60/100 in January) can, in part, be associated with general asset price movements in the region following last year’s Q4 rally, but also with political tensions,” the Quantum paper notes.

According to Quantum, the upside of Argentina’s debt prices in a scenario of relative normalization is higher -even considering a future restructuring, entry prices would more than offset it- than that of Ecuadorian bonds”.

DIFFERENCES BETWEEN THE TWO COUNTRIES

The Quantum report notes that Ecuador’s economy is “stable” and has been dollarized since 2000.

It also notes that the country has maintained positive growth rates in recent years, but the political crisis has escalated.

“The outcome of the political crisis anticipates greater strength and dominance of the line of former President Rafael Correa.”

“In Argentina, on the other hand, the economic crisis has been manifesting itself in one form or another for some time and was practically constant in the period we are considering.”

“This derives in political tensions, which, however, are contained within a general institutional framework that maintains republican forms and practices, without interruptions,” Quantum compares.

Quantum Finanzas maintains that Ecuador’s economic indicators are “substantially better” than those of Argentina in terms of inflation, external sector, fiscal balance, and public debt, although it clarifies:

“The question is whether dollarization and its rigidity in terms of economic policy decisions, beyond the fact that it allowed sustaining stability for many years in Ecuador and that, in general, the economy shows better indicators than Argentina, is more advantageous to achieve a sustained growth that allows reducing the costs of indebtedness”.

This doubt raised by Quantum Finanzas is because the Ecuadorian economy is dollarized and is usually the model used as an example by those who want to dollarize in Argentina.

“Both countries face political difficulties that impact their economies (crack). In Ecuador, even with a history of tensions and greater fragility”, summarizes the report.

With information from Bloomberg

News Latin America, English news Latin America, Argentine econo