provisions aim to restrain hedge funds from purchasing sovereign bonds for the purpose of seeking a profit through litigation.

New York Lawmakers Float Crackdown on Hedge Funds' Sovereign-Debt Tactics

By Alexander Gladstone

(Dow Jones) -- Some New York lawmakers are planning legislation designed to blunt hedge funds' ability to resist sovereign-debt restructurings, while easing financial settlements for government borrowers in distress.

New York state Sen. Gustavo Rivera and Assemblywoman Maritza Davila, both Democrats, plan to introduce legislation as soon as this week to allow a supermajority of a nation's creditors to amend or restructure its debt contracts and bind any dissenters that could otherwise hold out.

Many sovereign bonds in Latin America, Africa, and other emerging markets contain collective-action clauses that require all creditors to honor agreements that a majority of them make with the borrower. But others lack any such mechanism, leaving no ready way for settlements made with majority support to become binding on all members of a creditor class.

This means that financial investors can buy distressed sovereign debt at a discount, then refuse to accept a restructuring negotiated by other creditors, push for a higher recovery and possibly litigate for full repayment.

A small number of determined bondholders led by Paul Singer's Elliott Management Corp. refused to go along with other investors when Argentina restructured its debts after a 2001 default. These holdouts later sued Argentina in the U.S. and won court rulings blocking payments to other creditors and locking Argentina out of credit markets. In 2016 the country settled the dispute at significant cost, handing huge profits to Elliott and the other holdouts.

Unsustainable sovereign debt burdens can limit access to capital markets, drive up borrowing costs and restrict a developing nation's ability to fund capital projects or finance essential services. Prolonged debt restructurings have also exacerbated hardships for the populations of struggling countries, including deepening a famine in the Democratic Republic of Congo, according to progressive activists who support the New York legislation.

Since roughly half the world's sovereign debt is governed by New York law, the legislation could provide an international framework for struggling countries and territories to more easily restructure their debts and obtain financial relief, according to the activist group, which includes Center for Popular Democracy and New York Communities for Change.

Members of the group emphasized that New York is home to many immigrant communities from countries in which sovereign restructurings were drawn out by financial investors seeking to boost recoveries.

"New York has the power to completely change and restructure the way vulture funds operate across the world," said New York State Senator Gustavo Rivera. "That's why I am currently working on a piece of legislation that will hold multibillion-dollar hedge funds accountable for the destruction that comes with betting on a nation's economic failure and close some of the loopholes that allow these hedge funds to rake in such profits."

Democrats control the New York Senate and Assembly. Representatives for Assembly Speaker Carl Heastie and Senate Majority Leader Andrea Stewart-Cousins said they would review the legislation. A spokesman for Democratic Gov. Andrew Cuomo also said he would review it.

A risk of the legislation is that investors would sue to challenge it, since it could retroactively change certain contracts already in place. Changing contract rights can be justified under certain circumstances, if doing so advances a compelling state interest.

Bill components also include giving new lenders priority over a nation's existing creditors, mandating an audit before any restructuring, and empowering the New York State Department of Financial Services to oversee elements of the negotiating process. Other provisions aim to restrain hedge funds from purchasing sovereign bonds for the purpose of seeking a profit through litigation.

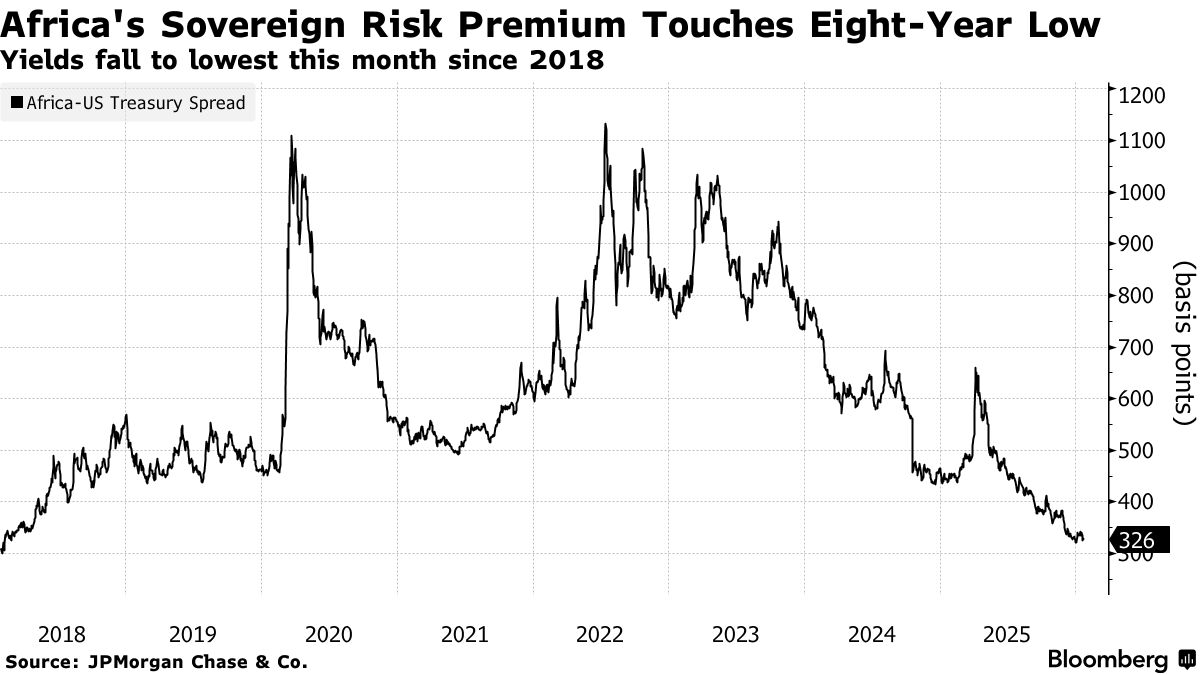

Developing countries around the world braced for clashes with private investors last year over financial pressures stemming from the Covid-19 pandemic, as governments in emerging markets confronted slowdowns in global growth and trade and huge health-care costs. After a widespread selloff in March, investors regained their appetite for emerging-market debt last year along with advances in vaccine development.

--Jimmy Vielkind contributed to this article.

Keine Kommentare:

Kommentar veröffentlichen