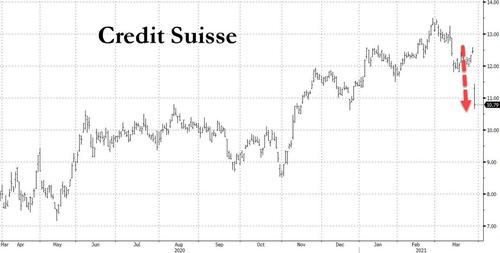

Prime Brokers Pounded: Credit Suisse, Nomura Crash On Archegos Margin Call Shockwave

Update (615am ET): Just around the time Nomura closed down 16.3%, its biggest drop on record after warning it faces around $2 billion in prime brokerage losses (see below) tied to a single US client - the now infamous Archegos tiger cub hedge fund - Swiss banking giant, Credit Suisse, was also swept up in the Archegos vortex after the Swiss bank said it faces a potentially “highly significant” loss from a U.S. hedge fund client defaulting on margin calls, sending the Swiss bank's share plunging as much as 16%, the most since March last year and wiping out all 2021 gains.

While the actual loss number was not defined, estimates pegged it in the $2-3 billion ballpark, and one commentator said that "Credit Suisse $CS lost its entire year profit because it is out-smart by Goldman aka the Sharks on the street and by a One Day."

Keine Kommentare:

Kommentar veröffentlichen