Politics

Ecuador Bonds Soar as Millionaire Banker Wins Presidency

By and- Guillermo Lasso, 65, will be sworn in as president next month

- Win by Lasso set to reassure bondholders on upholding IMF plan

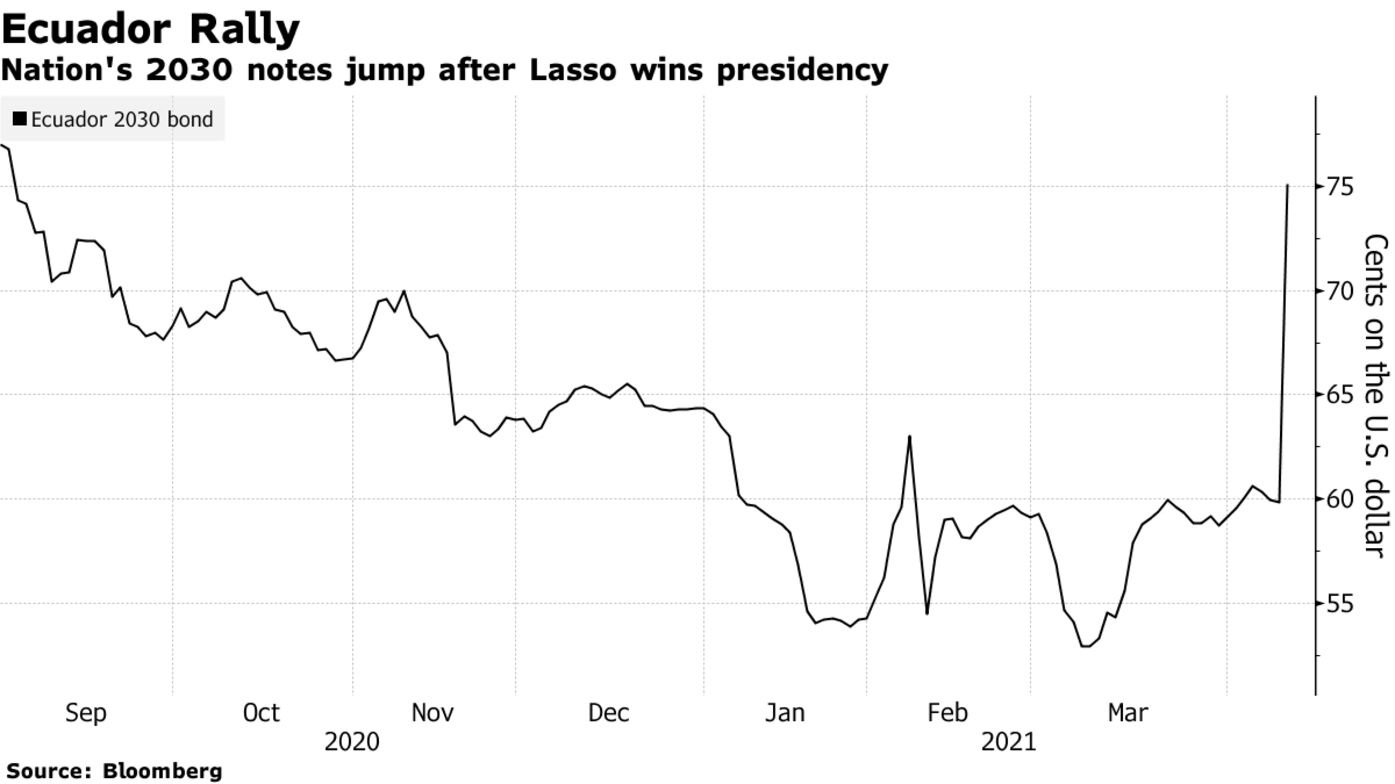

Ecuadorean bonds rallied after career banker Guillermo Lasso won the presidential election with a late surge in support, calming investors who thought his opponent was likely to lead the default-prone country into insolvency once again.

Lasso beat out economist Andres Arauz, a left-wing protege of former President Rafael Correa, by a solid margin in Sunday’s runoff vote. Arauz, who conceded defeat, won February’s first round by 13 percentage points.

It was a massive relief for bondholders, who bid up the country’s benchmark notes to their biggest gain since they were restructured just eight months ago. Ecuadorean debt had been trading at levels that signaled broad investor skepticism amid worry that a victory for Arauz would lead to unsustainable levels of social spending and an inevitable default from a politician who promised to prioritize the poor over the powerful.

Lasso, a 65-year-old self-made millionaire and father of five, was largely seen as representing the establishment, having vowed to uphold a $6.5 billion financing agreement with the International Monetary Fund and to keep up payments on the country’s overseas bonds. In his victory speech Sunday evening, Lasso said he will work to create “the prosperity we all long for.”

“Lasso’s victory should reduce political uncertainty and raise the prospects of a fairly orthodox and market-friendly macro policy agenda,” Goldman Sachs Group Inc. analyst Tiago Severo wrote in a note.

Morgan Stanley, Stifel Nicolaus & Co. and TPCG Valores were also among the firms to turn bullish on Ecuador’s bonds in the wake of Lasso’s victory, betting that gains would be extended beyond today’s rally.

The country’s $3.7 billion of bonds due in 2030 surged almost 15 cents to 74 cents on the dollar, by far the biggest price jump since they were restructured.

Ecuador’s southern neighbor Peru also held presidential elections Sunday, with exit polls suggesting a messy runoff after no candidate got near the threshold needed for a first-round win. Its overseas bonds edged lower.

With some 99% of votes counted in Ecuador, Lasso had 52.4% to 47.6% for Arauz.

Why Ecuador’s Runoff Vote Matters for the Bond Market: QuickTake

The campaign for control of Ecuador, an oil exporter and world-leading producer of bananas, shrimp and the balsa wood crucial for wind-turbine rotors, has implications beyond is borders.

Arauz, 36, who pledged to use central bank reserves to pay poor families, had been expected to strengthen ties with left-leaning governments in the region including in Cuba, Mexico, Venezuela and Argentina. Lasso’s win represents more of a focus on ties with Washington, and with U.S.-aligned governments in countries such as Chile, Colombia and Brazil.

Sigh of Relief

While bond investors breathed a sigh of relief, Lasso won’t have an easy time running the country of 17 million people amid a sluggish vaccination campaign. Last year the dollarized economy contracted 7.8% as the pandemic dessimated activity, its worst performance since at least the 1970s.

To govern successfully, Lasso will have to establish a working relationship with the National Assembly, where his backers hold just 31 of the 137 seats. He will also need to reach out to the more than 1.8 million Ecuadorians who voided their votes, including many from indigenous movements.

Lasso will find it tough to implement unpopular economic policies since legislators from other parties will be reluctant to spend their political capital on his behalf, according to Maria Jose Calderon, political scientist at the Pontifical Catholic University in Quito.

Creating Jobs

The president-elect has said he’ll promote policies that boost investment and private-sector job creation, and will phase out a tax on taking money out of the country. He’s also promised to boost the monthly minimum wage to $500 from $400, and oversee the vaccination of 9 million people against Covid-19 during his first 100 days in office.

Even if Lasso encounters challenges in implementing his political agenda, it will be easier for him and the IMF to find a middle ground as they negotiate timelines for austerity measures, according to Nathalie Marshik, head of emerging-market sovereign research at Stifel Nicolaus & Co. in New York.

During the campaign, Lasso rejected increasing taxes to meet IMF austerity targets, even though Ecuador has one of the region’s lowest value-added taxes at 12%. Recent gains in crude oil, the country’s biggest export, as well as the close to $1 billion the country can expect to gain from the IMF’s planned increase in special drawing rights will give him previously unexpected fiscal breathing room.

“This could offer the new government some room to postpone some of the planned measures or design an easier-to-swallow version of tax reform,” Barclays analyst Alejandro Arreaza said in a research note. Ecuador might even be tempted to return to the financial market sooner than planned under the IMF deal if yields fall low enough, Arreaza added.

— With assistance by Philip Brian Tabuas, Ben Bartenstein, Aline Oyamada, and Alan Crawford

Keine Kommentare:

Kommentar veröffentlichen