Markets

Buenos Aires Province Sued in U.S. for Missed Debt Payments

By and- Creditors’ plan comes after failed debt talks with officials

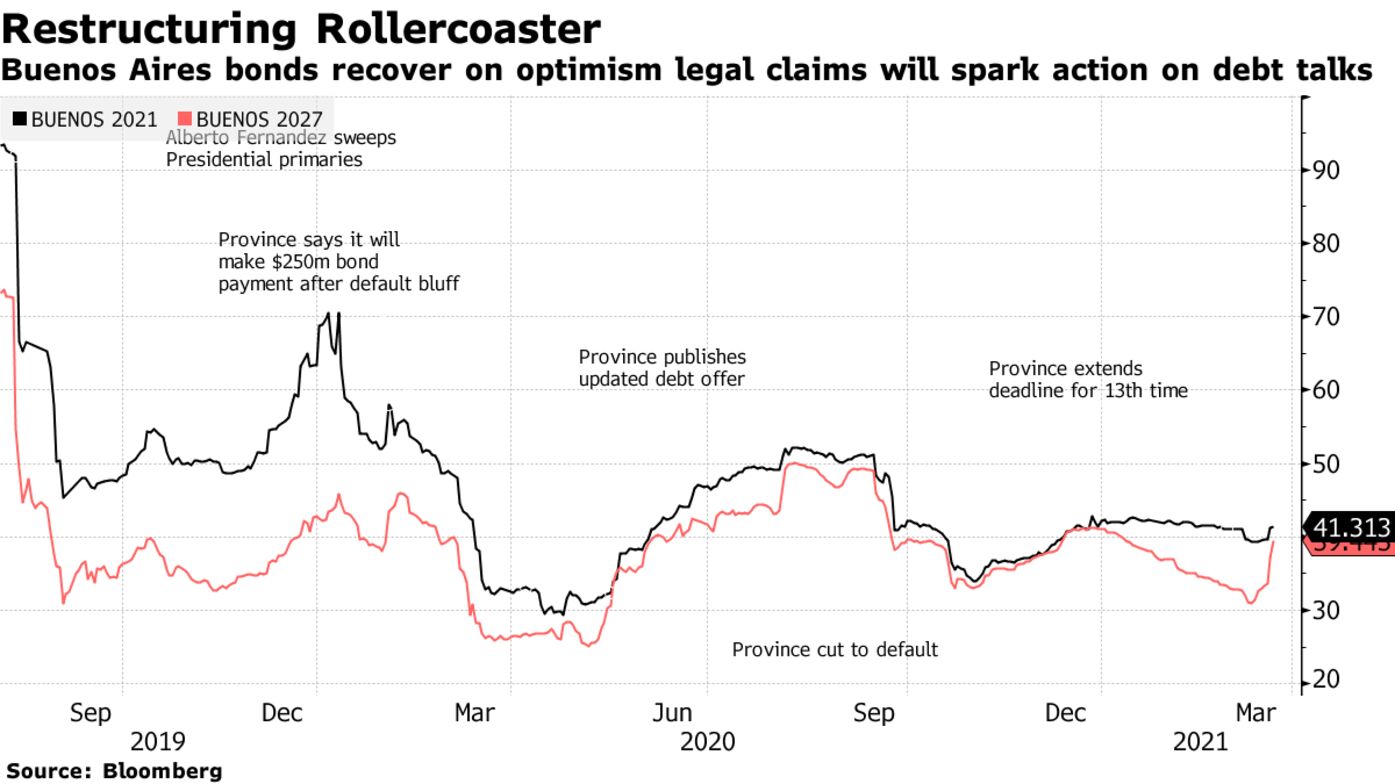

- Province’s deadline for debt offer has been extended 13 times

Holders of bonds from Argentina’s largest province have filed lawsuits in New York for more than $366 million in unpaid principal and interest.

The Steering Committee of the Ad Hoc group of province bondholders submitted two legal claims against the province of Buenos Aires in the U.S District Court for the Southern District of New York after negotiations to restructure $7.1 billion in overseas debt stalled, according to complaints filed Tuesday.

The plan comes after a lack of progress in restructuring talks between the province and investors, more than six months after the federal government struck a deal to restructure $65 billion in sovereign bonds. The province published details of a new proposal shown to one of its largest creditors, GoldenTree Asset Management, on Monday, but the fund rejected the terms and the province didn’t accept a counteroffer that followed.

“Since April, the Province has made virtually no effort to engage in good faith negotiations with the Group to find a mutually agreeable and consensual solution, despite several attempts at engagement by the Group and its advisers,” according to a press statement. “Actions speak louder than words, and it is regrettable that the Provincial leadership has chosen to follow a course of confrontation and default.”

According to the two complaints, the creditors are demanding unpaid interest for $133 million and unpaid principal for $233 million. The complaints were filed separately to mark that the outstanding bonds were issued under two different legal indentures.

The press office for the province of Buenos Aires’ economy ministry didn’t reply to a request for comment. Buenos Aires has extended the deadline for creditors to accept its proposals more than a dozen times since its first offer appeared in April.

The province’s $1.75 billion in bonds due 2027 rose 1.2 cents to 38 cents on the dollar, their highest since Jan. 19.

A half-dozen other provinces, from Salta in the north to Neuquen in the south, have sealed restructuring deals over the past year amid an economic and currency crisis exacerbated by the pandemic.

Among the funds named in the complaints are Amundi Asset Management, Beauregard Holdings LLP, Greylock Global Opportunity Master Fund, and GoldenTree Asset Management. The latter had been in talks with the province over the weekend, and rejected an amended debt proposal from province officials after negotiations stalled.

READ MORE: Debt Restructuring Talks Stall for Argentina’s Biggest Province

“Whether this new suit actually strikes fear into the PBA team or not will depend on the parallel negotiation around GoldenTree’s counterproposal,” said Walter Stoepplewerth, chief investment officer at Portfolio Personal Inversiones in Buenos Aires.

A Long Road

Home to about 40% of the nation’s population, the province kicked off its debt restructuring process in Jan. 2020 when Governor Axel Kicillof first said he would delay a $250 million capital payment. He ended up transferring the money anyway.

Months later, the province proposed a fresh restructuring offer that was again rejected by creditors, and rating companies cut the province to selective default after it missed a payment in May.

“The members of the Group who have today filed claims remain open to considering proposals from the Province that fairly reflect the reality of the Province’s financial and economic position,” according to the statement. “In the meantime, they intend to vigorously pursue the legal proceedings that they have initiated today, and reserve in full their right to exercise additional available remedies at any time.”

This is not the first legal claim against an Argentine province. In January, Entre Rios province was sued for a missed interest payment in New York court, but bondholders said they would drop the legal claim after reaching a deal.

— With assistance by Patrick Gillespie, Bob Van Voris, and Chris Dolmetsch

Keine Kommentare:

Kommentar veröffentlichen