Argentina’s Central Bank Move Raises Inflation Concerns

By and- Banks allowed to buy treasury notes with reserve requirements

- Analysts warn measure risks weaker rules, banks’ exposure

A measure allowing Argentina’s commercial banks to move part of their reserve requirements from central bank notes to treasury bonds is raising concerns about inflation and the financial system’s health.

The country’s central bank said late Thursday that the move is intended to boost liquidity in the local, treasury debt market. The option is voluntary: banks aren’t obliged to buy the treasury notes, which are considered riskier, longer-term assets compared to the very short-term central bank debt.

An official at the monetary authority said the change wouldn’t put the banks at risk because liquidity requirements remain in place and not all of the central bank’s 7-day notes can be converted into treasury bonds, only a portion.

The policy move would not have an impact on the credit quality of Argentine financial entities in the short term, according to a statement issued Friday by Moody’s Local Argentina, a domestic credit ratings platform that’s part of Moody’s Corporation.

Still, analysts warn that the measure risks stoking inflation by financing more government spending and exposing commercial banks to a government infamous for being a serial defaulter. Consumer prices are up 46% from a year ago, and Argentines’ inflation expectations have hit a record.

“This measure is going to be reflected in higher inflation eventually, because monetarily it’s expansive,” said Marcos Buscaglia, founder of consulting firm Alberdi Partners in Buenos Aires.

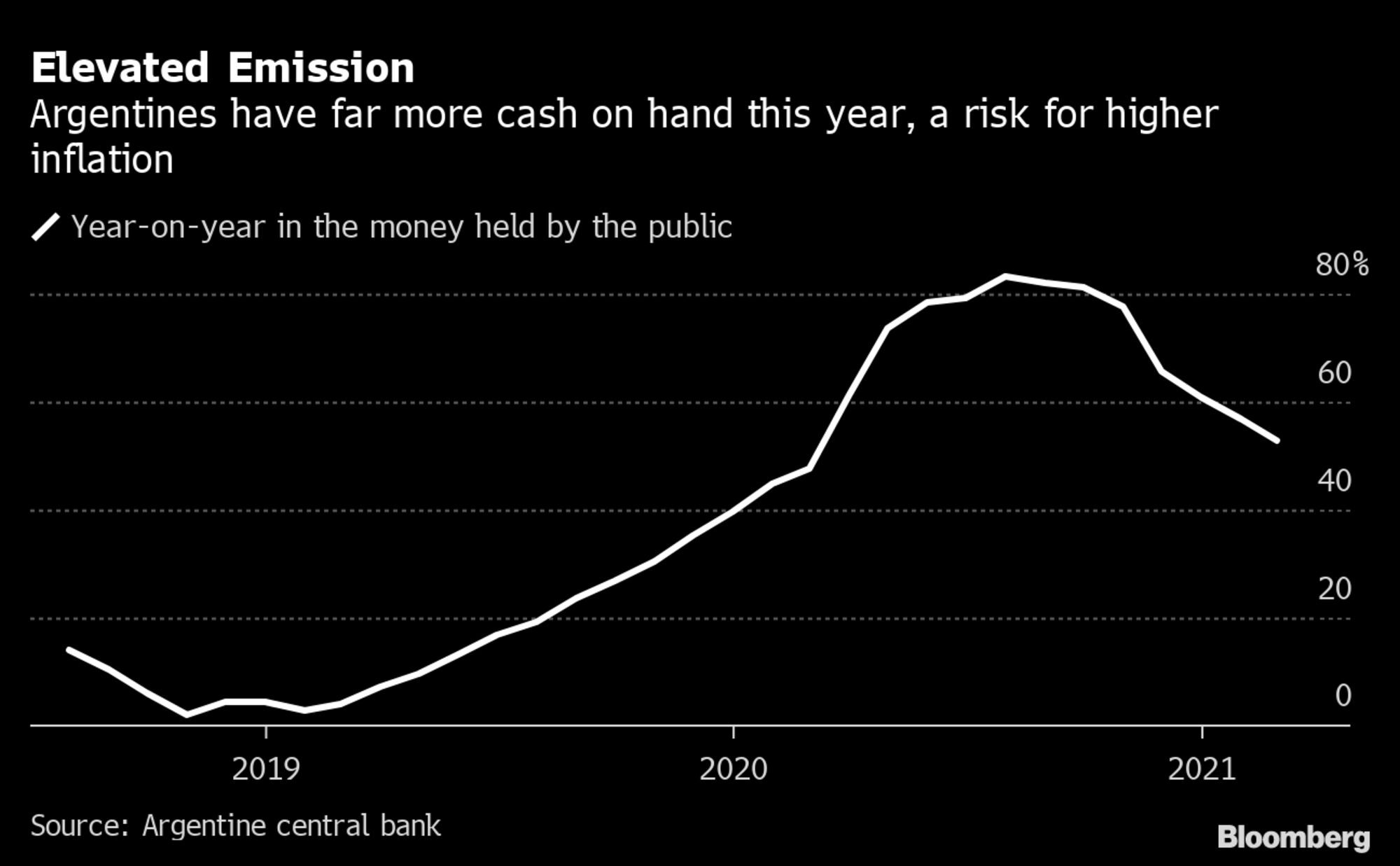

Elevated Emission

Argentines have far more cash on hand this year, a risk for higher inflation

Source: Argentine central bank

Former policy makers evoked memories of Argentina’s 2001 banking crisis, when a government default triggered a domino effect in the financial sector because its institutions held an excessive amount of treasury notes.

“The central bank today announced a measure that puts at risk one of the few important consensuses that economic policy had achieved: Prudent regulation of the banking system,” Guido Sandleris, the central bank chief until late 2019 under the previous government, tweeted on Thursday. Breaking from that consensus “to marginally reduce the government’s financing costs is a bad sign.”

Read more: In Argentina, March Activity Drop Still Allows for 1Q Growth

Treasury notes today offer a premium of between 200 and 300 basis points higher than central bank notes. For banks, the trade-off is taking greater risk and investing the money over periods of 180 days or more, while the central bank offers 7-day notes.

The decision comes as Argentine officials need to finance more Covid-19 social spending that wasn’t anticipated, as a record wave of cases has triggered another severe lockdown. Analysts have also warned in recent weeks about decreasing rollover rates of treasury debt auctions.

Read more: Argentina Inflation Rose Faster Than Expected Again in April

The central bank official said banks could use up to 800 billion pesos ($8.5 billion dollars) -- equivalent to 32% of the monetary base -- of the reserve requirements that they have invested today in Leliq, central bank notes, to buy Treasury securities. Holdings of the Leliq notes total 2 trillion pesos and have nearly doubled since early 2020.

Analysts warn that if commercial banks shift their reserve requirements from the central bank to treasury bonds, it may not count toward the legal limit of exposure they can have toward government debt.

“Banks remain much more exposed to the public sector,” said Fausto Spotorno, director of economic research at consulting firm Orlando J. Ferreres y Asociados. “A certain risk exists that in the case of a run on peso deposits, you’d have a debt problem, or conversely, in the case of a debt default in pesos, you’d have a problem with deposits.”

Keine Kommentare:

Kommentar veröffentlichen