Money Managers Say It’s Time to Get Picky in Emerging Markets

By , , and- Investors weigh impact of Covid, inflation on asset class

- Mexican, South African, Taiwanese securities among top picks

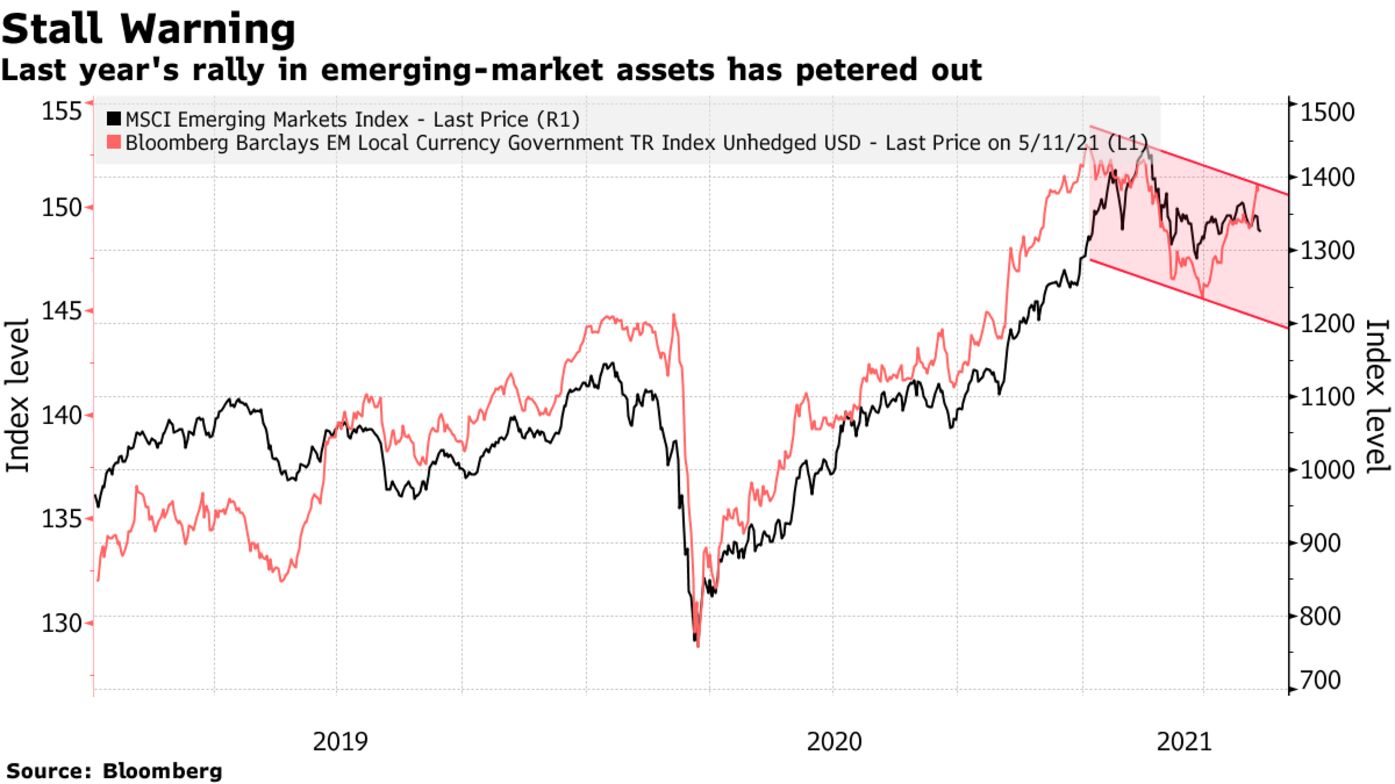

Emerging-market investors are turning more selective as last year’s everything rally splinters under the weight of higher inflation expectations.

Exposure to U.S. growth and the impact from higher commodity prices are some of the criteria used by money managers from JPMorgan Asset Management to State Street Corp. Mexico, South Africa and Taiwan rank among the top choices as firms pare back their bullish bets for developing-nation assets, according to recent surveys.

“There is still meaningful scope to generate returns within EM as long as investors are able to differentiate,” said Tai Hui, chief Asia market strategist at JPMorgan Asset Management in Hong Kong.

Investor enthusiasm toward emerging-market assets has waned this year as Covid-19 infections engulf nations from India to Brazil while Treasury yields push higher amid rising price pressures. The MSCI Emerging Markets Index has slid almost 10% since its mid-February high and the Bloomberg Barclays EM Local Currency Government Bond Index is down 1.6% from its January peak.

U.S. Exposure

With a strong recovery in the world’s largest economy set to drive global growth this year, investors are looking for ways to piggy-back on that trend.

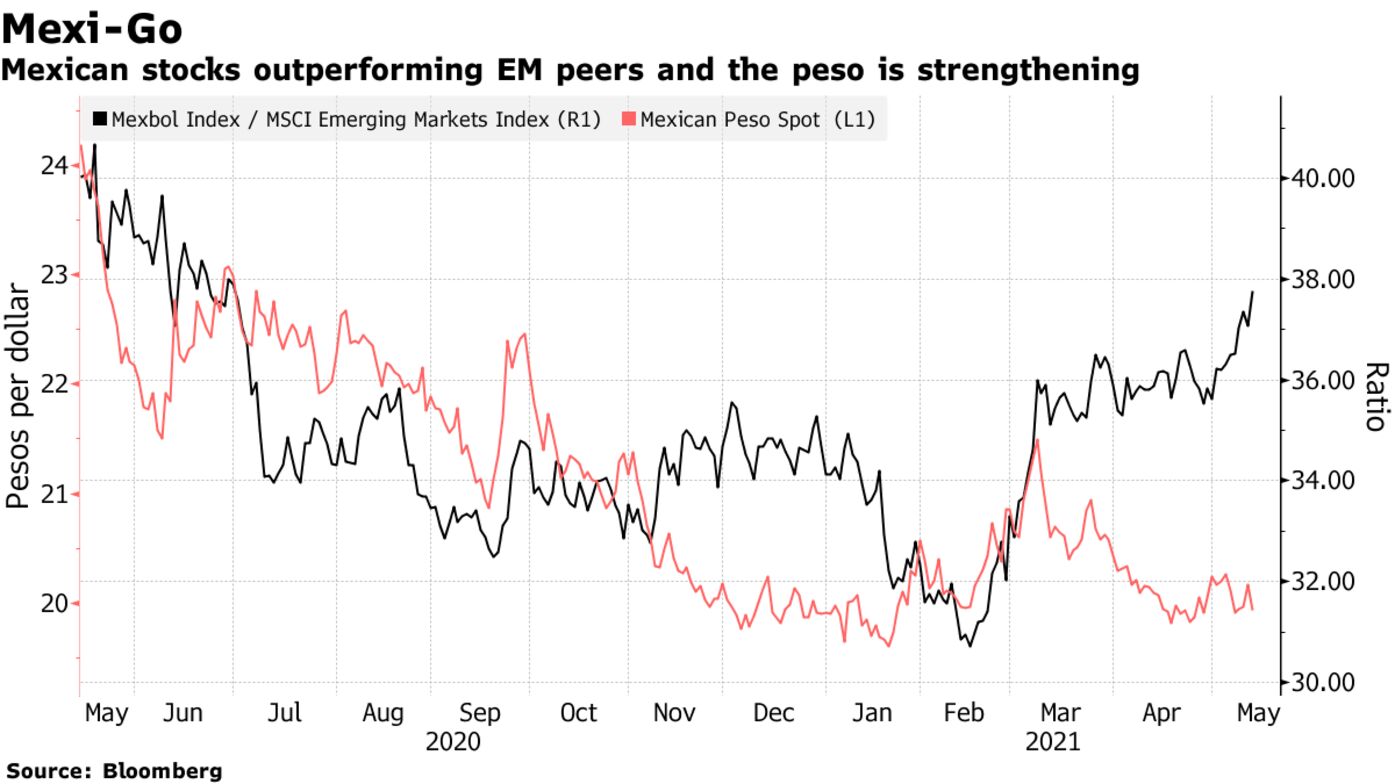

That makes Mexican, Taiwanese and South Korean equities attractive given their strong ties to the U.S., said Shaniel Ramjee, a senior investment manager at Pictet Asset Management in London, who helps manage $252 billion.

The Mexican stock benchmark has climbed 12% this year, easily beating the 1% rise in MSCI’s index of developing-nation shares. The South Korean and Taiwanese equivalents are also outperforming, though the latter saw a steep selloff last week amid jitters over a Covid-19 outbreak and pricey tech stocks.

Tech Dominance Haunts Taiwan in Global Selloff: Taking Stock

Commodity Surge

The connection to commodity prices is also boosting the Mexican peso, said Emily Weis, a macro strategist at State Street in Boston. A combination of stimulus measures, vaccine rollouts and supply shortages has pushed everything from copper to lumber and iron ore to multiyear highs or records.

“Improving commodity prices are still a net positive for EM commodities currencies given the sheer percentage of exports,” Weis said.

The Russian ruble and South African rand also stand to benefit from the commodities rebound, according to Pictet’s Ramjee. The rand is the top emerging-market currency year-to-date thanks in part to South Africa’s exports of metals like platinum and iron ore, while the ruble has benefited from Russia’s oil exposure.

But perhaps nowhere is the power of the commodity boom more on display than Brazil, where exports of soybeans and iron ore have boosted the real.

Other nations haven’t been so lucky. Currencies in Colombia, Argentina, Peru and Turkey -- countries with some of the biggest increases in virus infections globally -- are among the worst performers in emerging markets this year.

Yield Spike

Some investors say they’re sticking with local currency-denominated bonds that may be more insulated from American monetary policy.

“Local markets are becoming more attractive,” said Shamaila Khan, the head of emerging-market debt at AllianceBernstein in New York, singling out South African, Russian and Mexican local bonds as among the most appealing. “Selectively, we are finding value.”

Rate Calls

Chile Votes

Biden-Moon Meeting

Data and Events

— With assistance by Lilian Karunungan, Nicholas Reynolds, and Debarati Ro

Keine Kommentare:

Kommentar veröffentlichen