Markets

Argentine Bonds, Stocks Gain After Vote Signals Change Ahead

By and- Price on dollar bonds climbs to highest in nearly a year

- Opposition ahead in most districts, key Buenos Aires Province

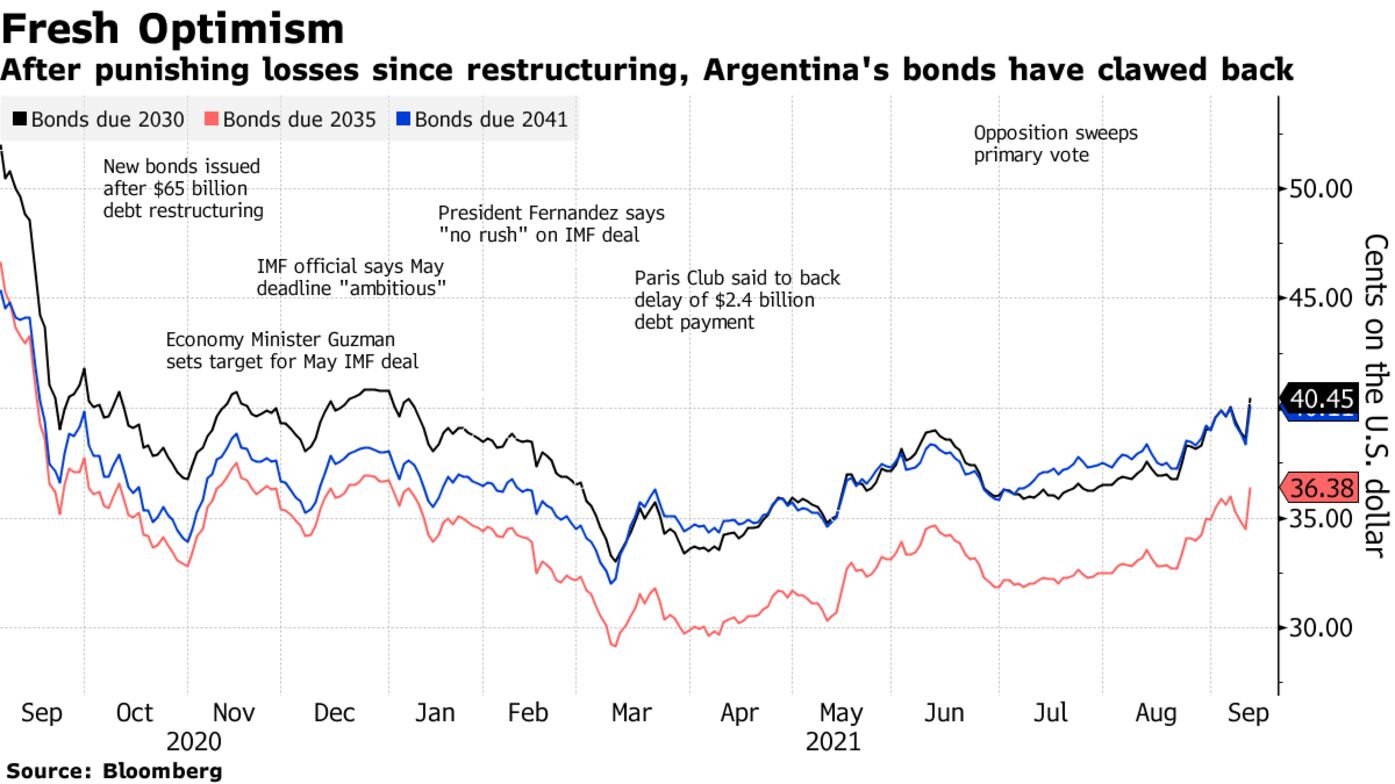

Argentine bonds rallied and stocks jumped the most in three weeks after opposition candidates did better than forecast in a primary election, signaling greater chances the government will lose majorities in Congress.

Prices for the government’s most traded dollar-denominated bond jumped almost 4% to the highest since January, while the cost to insure its debt against default fell to a three-week low. The Global X MSCI Argentina exchange-traded fund added 2.2%.

Investors cheered almost-complete results that showed the opposition Juntos por el Cambio coalition led most of the country’s districts in Sunday’s primary vote, including an unexpected victory in the Province of Buenos Aires, which accounts for more than a third of the electorate. While the primary is intended to pick candidates ahead of the Nov. 14 midterms, the way the vote is structured means the event acts as a major nationwide poll and scene-setter into what will happen two months from now -- and even who has the momentum into the next presidential election.

“The opposition staged a tremendous victory, which puts the government further from getting majorities in both houses and puts the opposition in line to recover the government in 2023,” said Marcos Buscaglia, founder of Buenos Aires-based consultancy Alberdi Partners. “Given the government is likely to accelerate fiscal spending and hence money printing from now till the November election, we expect the foreign-currency bonds and equity markets to rally but are less optimistic about the peso and peso-denominated assets.”

Read More: Argentina’s Ruling Coalition Dealt Blow in Midterm Wake-Up Call

Foreign investors have been frustrated by President Alberto Fernandez’s administration. While the government pulled off a $65 billion debt restructuring last year, it has so far failed to reach a new agreement with the International Monetary Fund or present any long-term plans to revive an economy decimated by years of mismanagement. Capital controls have been tightened and the government has intervened in multiple industries to try to control inflation.

In the short-term, the election results could result in more intervention by the federal government as officials boost spending in a desperate bid to win back voters.

“Capital controls will have to be tightened even more, because if one thing is for certain, the government will increase social spending which will be financed by the Treasury,” said Carolina Schuartzman, director of sales and trading at local broker Columbus Zuma in Buenos Aires. “The central bank will try to contain the parallel exchange rate, but their firepower will be limited with low liquid reserves.”

Argentina’s official exchange rate, controlled by the government’s crawling peg, was little changed at about 98 pesos per dollar. But last week, retail investors swarmed illegal exchange houses that allow them to skirt the controls, and the parallel-market peso reached 186.5 per dollar, its weakest level this year.

In Sunday’s balloting, the ruling bloc lost congressional battles in districts typically favorable to left-leaning politicians, such as La Pampa, Chubut, Chaco, Tierra del Fuego and even Santa Cruz, the home province of Vice President Cristina Fernandez de Kirchner. November’s midterms will decide half of the lower house seats and a third of the senate.

In a speech Sunday night, Alberto Fernandez acknowledged the defeat and promised to work on regaining voters’ trust.

“Evidently, there’s something we didn’t do right to get people to give us their support as we wished they had,” Fernandez said at campaign headquarters in Buenos Aires. “The campaign has just begun and we still have two months. We need to win it.”

— With assistance by Selcuk Gokoluk

Keine Kommentare:

Kommentar veröffentlichen