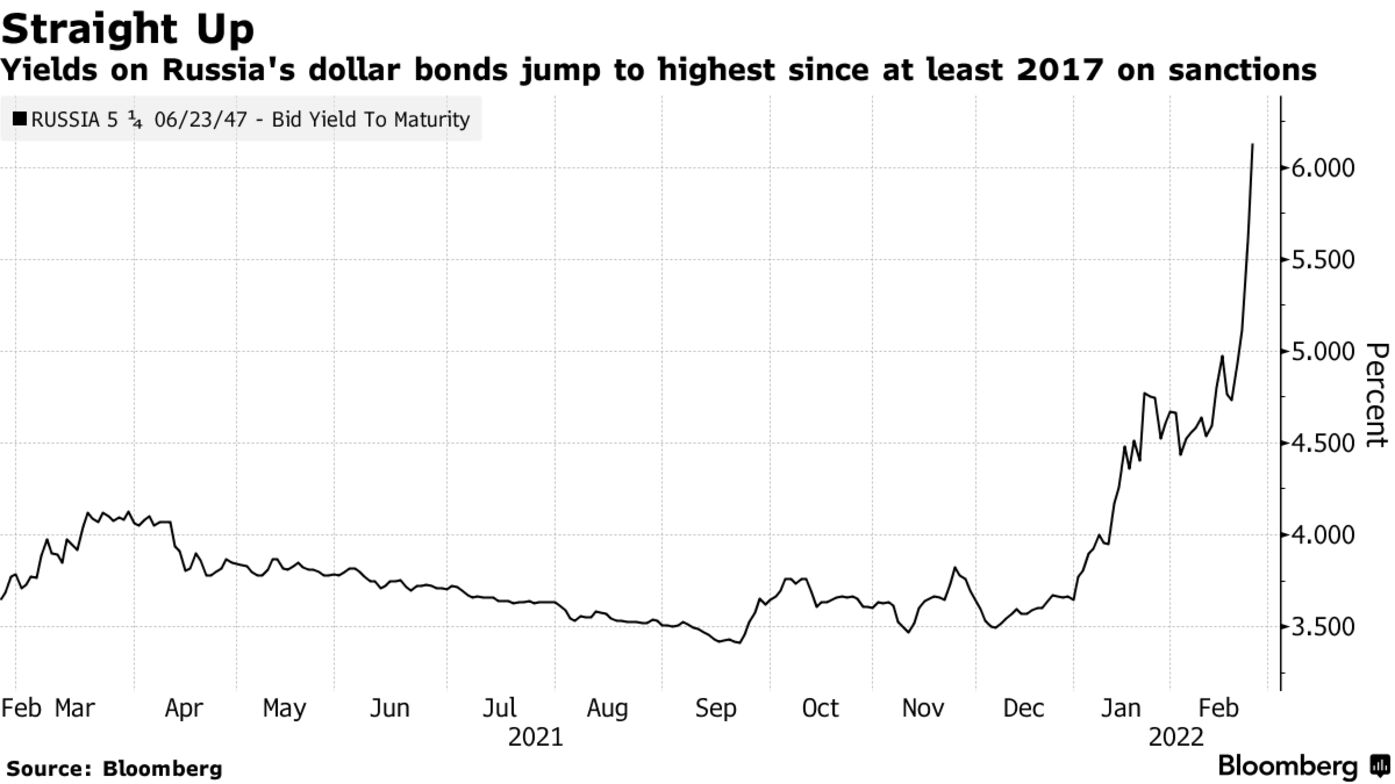

Russia’s Dollar Bonds Can’t Escape Blow of EU, U.S. Sanctions

- Yields on 2047 debt jump to highest since at least 2017

- EU to ban sale of ‘transferable securities’ issued by Russia

Russian bonds are finding it hard to escape the blow of sanctions from the U.S. and Europe, even as the country has taken steps in recent years to shield its economy from international punitive measures.

Yields on the nation’s $7 billion dollar debt due in 2047 topped 6%, set for its highest close since it was first issued in 2017. That comes as the EU is set to prohibit the purchase or sale of “transferable securities and money-market instruments issued” by Russia, according to draft documents seen by Bloomberg. Russian stock markets were shut for a holiday.

Read More: EU Matches U.S. Ban on Russian Bonds in Sanctions Package

Europe’s steps are in line with U.S. measures, which stopped short of more dramatic action. While that resulted in stocks rebounding and bond traders reigniting bets on interest-rate hikes globally, worries over Russian assets remain. Investors are weighing potential crippling actions that could affect a wider range of Russian banks, or extend to limits on the country’s ability to convert rubles for foreign currencies.

“The big one that has so far not happened would be to ban trading or holding or both of legacy bonds,” said Nick Eisinger, co-head of emerging-markets active fixed income at Vanguard Asset Management in London. “We are underweight Russia in the funds in any case. We reduced before this got really bad.”

Many U.S.-related investors -- who already face restrictions on buying Russian government bonds in the primary market -- won’t be allowed to buy in the secondary market any securities that are newly issued after March 1. The primary market appears to be the main target, but there could be knock-on effects for already existing debt and potential risks later on as Russia contemplates potential refinancing.

The sanctions, and potential for further measures, add to the pressure on Russian assets that have dropped sharply as the Ukraine crisis escalated.

The ruble fell 1.7% on Wednesday, the most among emerging-market currencies, and traders are bracing for a potential decline to a record low. Ukraine assets have also been dragged lower, with the hryvnia slumping to the weakest since 2015 and GDP warrants falling for a fifth day.

De-Dollarize

While the sanctions mean Russia will be unable to borrow abroad for a while, the country is well positioned to get by without foreign funding, said Guido Chamorro, London-based co-head of emerging-market hard-currency debt at Pictet Asset Management. Twin surpluses, low foreign debt levels and high reserves mean the nation is relatively self-sufficient, he said.

Russia has also taken steps in recent years to de-dollarize its economy, including pricing its exports in euros rather than the greenback. That has decreased its vulnerability to the ongoing threat of sanctions.

Read More: Russia Ditches the Dollar for Bulk of Its Exports to China (1)

During a previous period of tension with Russia in 2018, the U.S. Treasury Department warned that sanctioning the sovereign debt market would risk global financial turmoil. Now investors are weighing the odds of further sanctions -- and how they could manifest in markets.

“It makes it much harder for Russia to issue external debt, but they really don’t need it,” wrote Cathy Hepworth, head of emerging markets debt at PGIM Fixed Income, which oversees $72 billion in EM debt. Still, “if sanctions are intensified down the road (i.e. on more Russian banks), it may make it a bit more complicated for local banks to have as much capacity for local debt.”

U.S. residents held roughly $14 billion of long-term bonds from Russian issuers as of December -- a little more than Turkish bonds, but less than half of American holdings of Norwegian debt, according to the Treasury.

If “there is no more escalation, then we might not see much additional selling as prices have already adjusted,” said Pictet’s Chamorro. “But if there is additional escalation that results in additional stronger sanctions, then all bets are off.”

— With assistance by Justin Sink, Farah Elbahrawy, Carolina Wilson, Y-Sing Liau, Sydney Maki, and Garfield Clinton Reynolds

Keine Kommentare:

Kommentar veröffentlichen