Chevron, Reliance Meet With U.S. Officials to Discuss Venezuela

By- Companies seek to loosen U.S. sanctions against Venezuelan oil

- Topic of oil swaps that exchange crude for diesel is on agenda

An oil tank reads "Fatherland, socialism or death" at the Jose Complex 200 miles east from Caracas.

Photographer: DIEGO GIUDICEChevron Corp. and Reliance Industries Ltd. are meeting with U.S. State Department officials to request a rollback of some of the previous administration’s restrictions against Venezuela’s oil industry.

Representatives from the two companies are holding virtual discussions with officials this week, according to people with knowledge of the matter, who asked not to be identified because the information isn’t public. High on the agenda: reinstating transactions known as oil swaps that would allow companies to receive Venezuelan crude in exchange for supplying diesel, one person said.

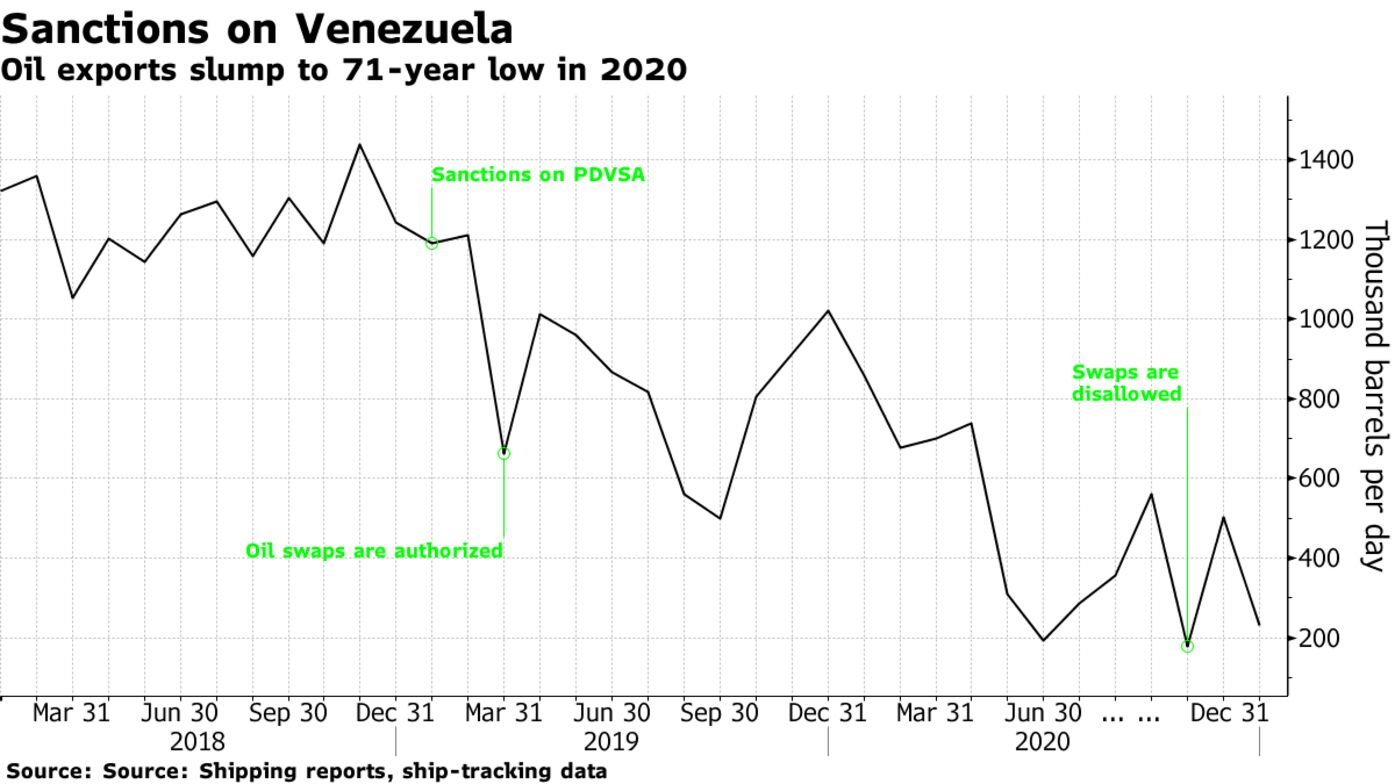

The U.S. imposed sanctions on Petroleos de Venezuela SA in early 2019, in an effort to dislodge President Nicolas Maduro from power by depriving his government of oil revenue. While some companies were still allowed to engage in limited dealings with the South American country, the swaps were nixed last October, said one of the people.

Indian refiner Reliance is seeking to revive those swaps. Meanwhile, Chevron, for now, wants to build goodwill and remind officials of its commitment to remain in Venezuela, another person said. The oil giant currently has until June to wind down operations.

The U.S. can’t ban international companies from buying Venezuelan oil. It can, however, financially squeeze them by prohibiting them from doing business with American companies if they ignore sanctions. Reliance and Chevron requested meetings with the State Department even though some of the key decisionmakers, including assistant secretaries to U.S. Secretary of State Antony Blinken, have yet to be confirmed by the U.S. Senate.

Ray Fohr, a spokesperson for Chevron, said the company is in regular conversations with multiple agencies within the U.S. government to make sure laws are understood. Reliance and the State Department did not immediately respond to an email seeking comment.

Venezuela is barely able to produce its own refined products because of widespread mechanical failures at refineries. Reliance is basing its request to resume oil swaps on the argument that the operations do not provide cash to the Venezuelan government but rather help lessen the humanitarian crisis there, one person said. Diesel is used in power generation, public transportation, agriculture and to deliver food and medicine.

The resumption of oil swaps could allow Venezuela to boost oil production, said Scott Modell, managing director at Rapidan Energy Advisors LLC. Output, which is currently at between 400,000 and 500,000 barrels a day, could hit 750,000 barrels day if the Biden administration eases some of the sanctions, he said.

Biden Drilling Ban Leaves Majority of U.S. Production Untouched

By- U.S. may lose up to 200,000 barrels a day out of 11 million

- Rystad analyst doesn’t see short-term price impact from ban

A Chevron Corp. deepwater oil platform in the Gulf of Mexico.

Photographer: Luke Sharrett/BloombergPresident Joe Biden’s temporary halt to drilling on federal lands leaves the vast majority of U.S. crude production untouched, though it may be the death knell for the Gulf of Mexico’s already dwindling output.

Should the halt announced Wednesday become permanent, the U.S. would stand to lose as much as 200,000 barrels a day of output by the end of this decade, according to Artem Abramov, head of shale research for Rystad Energy. It’s a small fraction of America’s roughly 11 million barrels a day of production.

“The region that would bear the brunt of this ban are the deep waters of the Gulf of Mexico since it’s entirely owned by the government,” said Elisabeth Murphy, ESAI Energy LLC upstream analyst for North America. It would mean a 40% output drop for the Gulf by 2030, she said. It’s a corner of the U.S. oil industry that has already seen investments shrink in recent years, with drillers focusing mostly on shale.

For the oil market, Biden’s restrictions on the energy industry, a focus on fiscal spending and a probable lack of urgency in lifting sanctions on Iran may actually help support crude prices this year and the next, Goldman Sachs Group Inc. said last week. Abramov doesn’t see a short-term price impact from a drilling ban.

Gulf of Mexico

Offshore crude production has been declining

EIA

Total spending in the Gulf of Mexico dropped by half in the four years through 2019, to less than $14 billion, Abramov said. Exploration spending went down by nearly 70% over the same period.

In the Permian Basin, on the other hand, only a small part of the prolific shale region is on federal land, and drillers there have stocked up on permits to maintain production levels in the coming years. North Dakota’s Bakken formation also includes some federal land, but like the Permian, operations there can move to private acreage.

“U.S. oil and natural gas producers can survive without new leases on federal lands, with the backlog of potential drilling unlikely to dent activity until the latter half of President Joe Biden’s term,” Bloomberg Intelligence analyst Vincent Piazza said in a note.

Oil companies exposed to the Gulf of Mexico may also shift investment to private shale land, said Rystad’s Chief Executive Officer Jarand Rystad.

Keine Kommentare:

Kommentar veröffentlichen