Ecuador Bonds Rise on Speculation Government Will Buy Back Debt

- Country to repurchase bonds, Finance Minister said in DC event

- Nation expected to announce blue bond sale in UN climate event

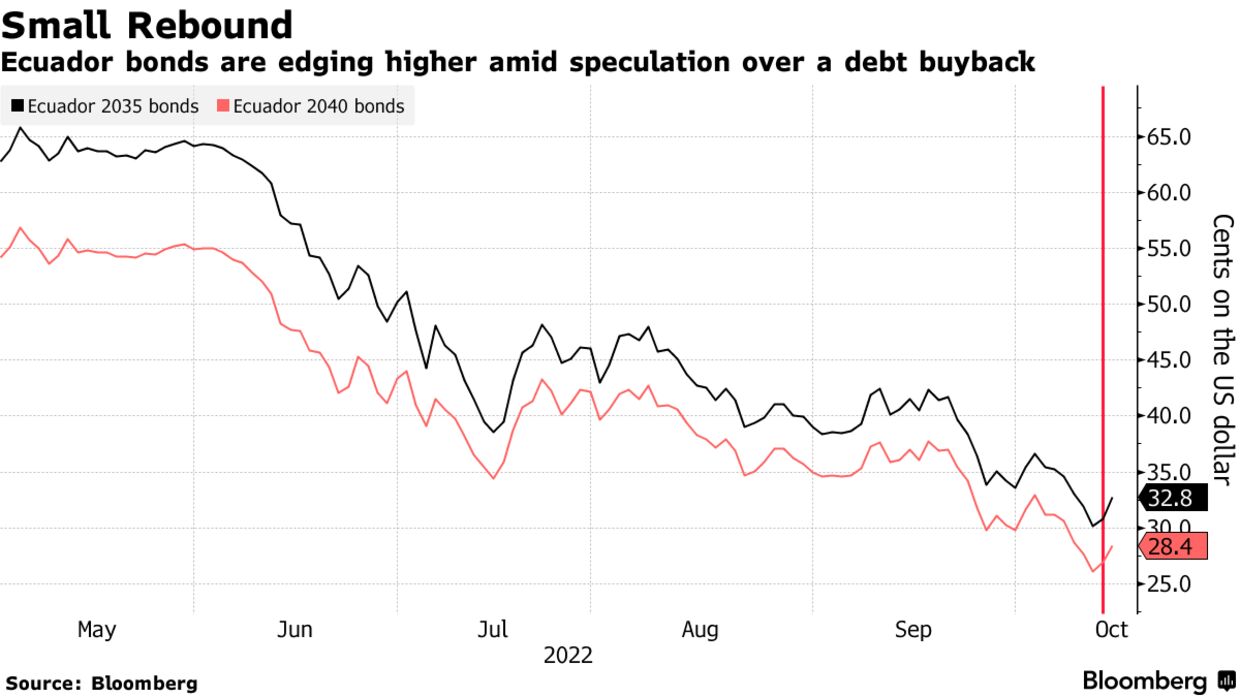

Bonds from Ecuador rallied on Monday, leading gains among emerging-market peers, amid speculation the government will buy back some of its outstanding debt.

Finance minister Pablo Arosemena said last week in a private event in DC the nation will sell blue bonds to buy back some outstanding debt, according to several investors who attended the session and asked not to be named. Bonds due in 2035 advanced 2.3 cent to 32.5 cents, the biggest advance in a month, while 2040 notes advanced 2.3 cent to 28.5 cents, the biggest move since June, according to indicative pricing data collected by Bloomberg.

Arosemena said the country will likely fund the buyback with the sale of blue bonds, a deal that will be announced at the United Nations Climate Change Conference next month, according to the people, who asked not to be identified because the information isn’t public yet. Ecuador’s Finance Ministry didn’t immediate reply to a request for comment from Bloomberg News.

Last year, Ecuador’s Environment Minister Gustavo Manrique said the government was in talks with the U.S. International Development Finance Corp. to sell a “blue bond” to pay for protecting a vast new marine preserve around the Galapagos Islands.

Keine Kommentare:

Kommentar veröffentlichen