Africa Taps Eurobond Market as Demand for Riskier Assets Jump

Takeaways by Bloomberg AI

- Cameroon priced a $750 million five-year bond at a yield of 10.125%, according to a person familiar with the matter.

- The nation is rated B-, six levels into junk, by S&P Global Ratings, and its biggest risk is what Cameroon looks like post Biya, its 92-year-old leader.

- Emerging markets are benefiting from investors shunning the US as geopolitical tensions rise, prompting nations to raise foreign-currency-denominated debt.

Cameroon became the second African nation in less than a week to sell dollar bonds, as frontier markets take advantage of risk-on sentiment to raise funds.

The central African nation priced a $750 million five-year bond at a yield of 10.125%, according to a person familiar with the matter. That compares with a yield of 10.75% on a seven-year dollar note it issued in 2024, when the country last went to market.

Cameroon is rated B-, six levels into junk, by S&P Global Ratings — the same as Nigeria, Pakistan and Angola.

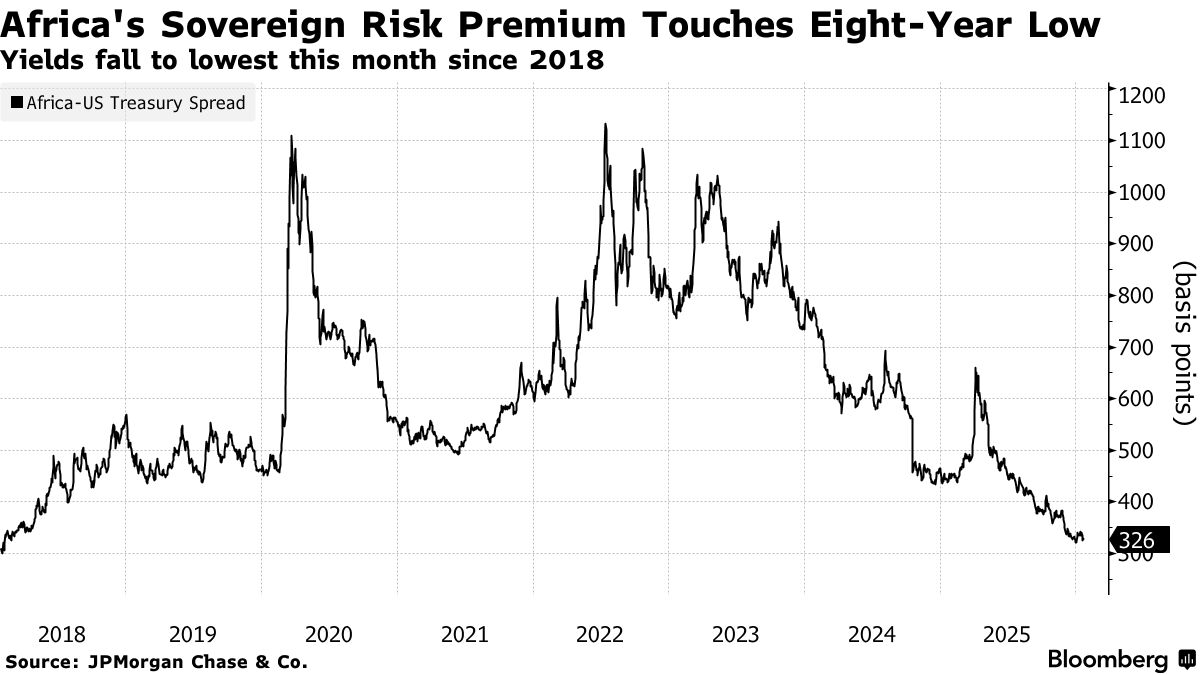

Emerging markets are benefiting from investors shunning the US as geopolitical tensions rise and the independence of the Federal Reserve remains a concern. Risk premia of African frontier markets from Mozambique to Gabon have narrowed to levels below 1,000 basis points over US Treasuries in recent days, prompting nations on the continent and elsewhere to raise foreign-currency-denominated debt.

With conditions having shifted since the last time it came to market, Cameroon should have been in a “position to issue in the single digits,” according to Leo Morawiecki, an emerging-markets analyst at Abrdn Investments in London.

“The biggest risk is what Cameroon looks like post Biya,” he said in reference to the nation’s 92-year-old leader Paul Biya, who won an eighth term in October. “And its very difficult to price that into the bonds as getting a grip on Cameroonian politics is extremely difficult.”

The nation’s $550 million dollar bond due 2031 added 0.27 cents on the dollar Tuesday to 100.80 cents, pushing the yield lower by 6 basis points to 9.31%.

Benin last week sold a $500 million seven-year note at a yield of about 6.2% and an inaugural dollar-denominated sukuk. Ecuador sold $4 billion of bonds on Monday, its largest-ever issuance, in a return to global credit markets after restructuring its debt in 2020. The Democratic Republic of Congo plans a debut $750 million offering in April, the country’s finance minister told Bloomberg last week.

| Read More About Debt Sales in Africa: |

|---|

Two African Debtors Exit Distressed Club, Leaving Only Senegal |

Seasoned eurobond issuers in Africa, such as Ivory Coast and Benin, are unlikely to care that other countries are coming to market given their years of experience, Morawiecki said. “But it likely does have a bigger impact on inaugural issuers such as DRC that look for signs of investor confidence in Africa.”

The continent’s average sovereign-risk premium over US Treasuries fell to the lowest since 2018 this month, and stood at 326 basis points on a closing basis on Monday, according to a a JPMorgan Chase & Co. index.

Sign up here for the twice-weekly Next Africa newsletter,and subscribe to the Next Africa podcast on Apple, Spotify or anywhere you listen.

— With assistance from Michael Cohen

Keine Kommentare:

Kommentar veröffentlichen