Angola Eyes $1.7 Billion Bond as Africa Issuer Pipeline Grows

Angola is weighing plans to issue a $1.7 billion bond on international capital markets this year, joining a list of prospective issuers across the continent from Kenya to the Democratic Republic of Congo.

The third-largest oil producer in Africa needs $16 billion in extra financing this year, according to the Angolan government. It plans to raise $8.4 billion through external funding sources, with the rest to be mobilized through domestic sources, according to a debt borrowing plan unveiled Tuesday by the finance ministry.

Angola last issued bonds in October and raised $1.75 billion. It has six dollar-denominated bonds, which rallied Wednesday and led gains across emerging markets. The yield on the $750 million note maturing in 2035 fell 13 basis points to 9.80%. About 80% of Angola’s external debt stock is denominated in U.S. dollars, with the remainder in other currencies.

Read More: Africa Taps Eurobonds as Demand for Riskier Assets Jumps

The country will stagger future foreign-currency-denominated debt issuance “so there is no longer a concentration of debt maturities in back-to-back years,” said Dorivaldo Teixeira, director of the Angolan Treasury’s Debt Management Unit. Angola has dollar-bond repayments due in 2028 and 2029, he added.

African debt is becoming increasingly attractive to global investors seeking high yields. Questions about US policy and dollar weakness are also boosting demand for emerging-markets assets, which is helping African issuers.

“As long as the US administration is OK with a weaker dollar, investors will be OK with emerging-market FX assets,” said Simon Quijano-Evans, an emerging markets economist.

Benin and Cameroon have already sold bonds this year. Kenya, which received a Moody’s Ratings upgrade on Tuesday, may seek a $2 billion bond, according to a news report. The Democratic Republic of Congo plans a maiden $750 million bond in April, the nation’s finance minister said in a recent interview.

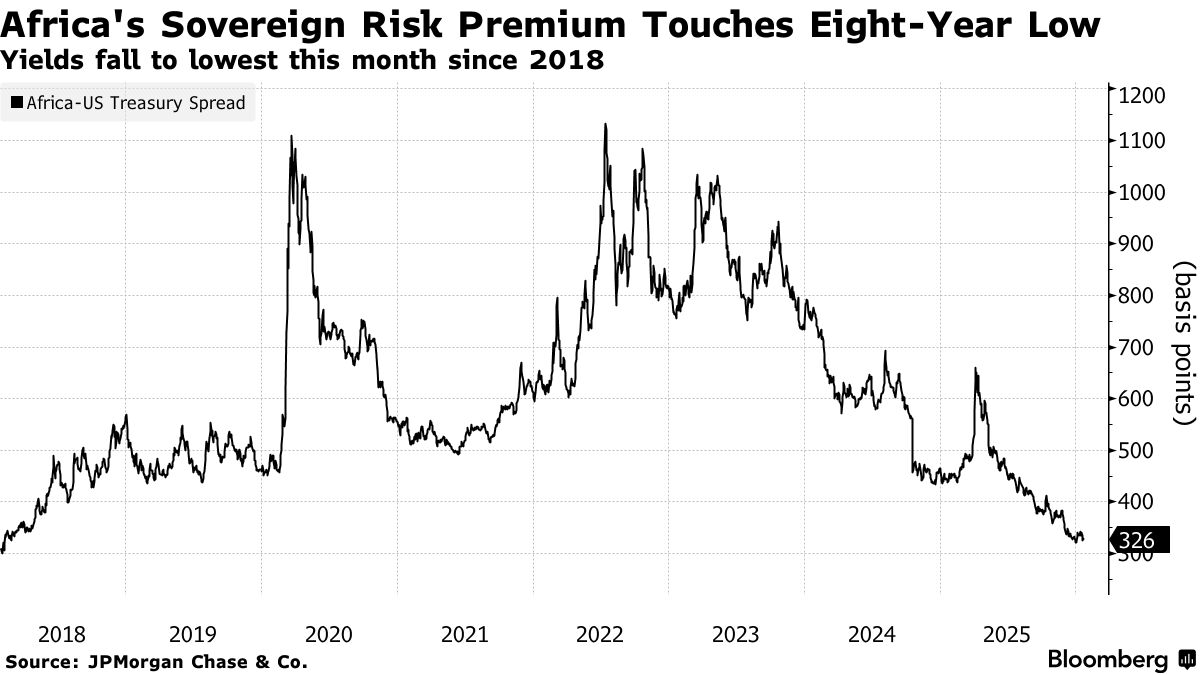

Although oil prices have lagged other commodities, which would normally weigh on Angola’s credit profile, demand for the bonds is high, said Vikram Rahul Aggarwal, an emerging-markets fixed income investor based in London. The sovereign risk premium in Africa — the yield which investors demand over holding US Treasuries — narrowed to the tightest since 2018, which is making borrowing attractive. Overall emerging market hard-currency sovereign spreads are close “to record tights” and most Angola bonds tend to be sold around a 10% yield, he said.

Sign up here for the twice-weekly Next Africa newsletter, and subscribe to the

Keine Kommentare:

Kommentar veröffentlichen