Buenos Aires Swap Gets 90% Support After $7 Billion Default

By- Accord with creditors could pave way to end a 16-month default

- Buenos Aires won’t extend Aug. 27 deadline for its offer

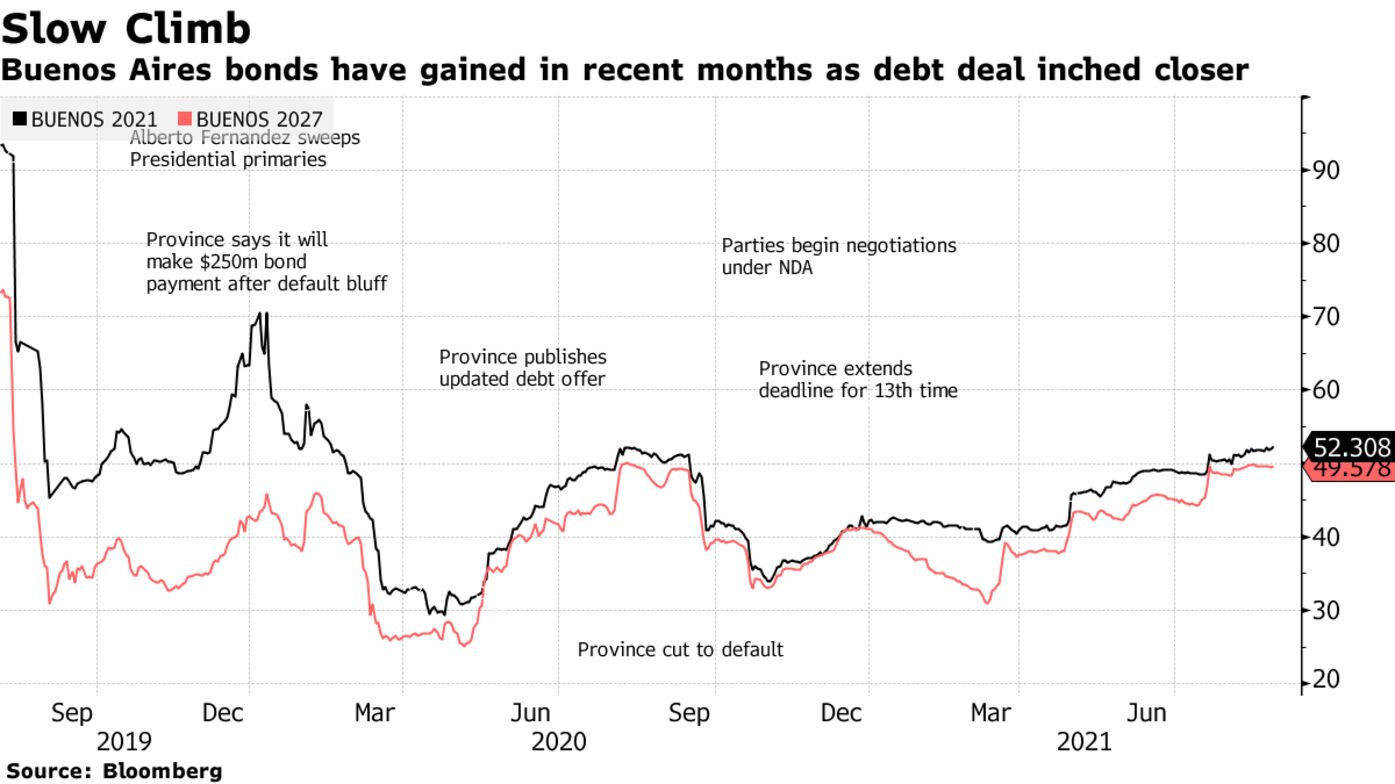

Argentina’s Province of Buenos Aires claimed success in its efforts to restructure more than $7 billion of overseas debt, putting it a step closer to emerging from a 16-month default.

Investors holding more than 90% of the bonds agreed to swap their notes for new securities, the province said in a statement. The offer, which analysts estimate will hand investors a bit more than 50 cents on the dollar, is set to expire mid-day Friday in Buenos Aires.

The province and its creditors have been in months of negotiations over the bonds after the province stopped making payments in the early days of the coronavirus pandemic, and some investors have sued in New York courts. But earlier this month Buenos Aires’ biggest investor, GoldenTree Asset Management, accepted the latest debt proposal put forward by the province and urged other creditors to sign on as well.

“It’s been a long 16 months post-default and a final chapter of debt restructuring across Argentina’s sovereign and quasi-sovereigns,” said Siobhan Morden, the head of Latin America fixed income at Amherst Pierpont Securities.

It wasn’t immediately clear if enough investors had signed on to the deal to trigger collective action clauses in all of the outstanding notes. If participation levels don’t reach certain thresholds, so-called holdout creditors could refuse to participate in the deal and instead take their cases to court. A smaller group of creditors said last month that the proposed deal contained “deeply coercive elements.”

Read More: It’s Deja Vu in Buenos Aires as Bond Clauses Shape Debt Talks

Home to almost 18 million people and accounting for two-fifths of Argentina’s gross domestic product, Buenos Aires has been in default on more than $7 billion in overseas bonds since April 2020. Buenos Aires is one of the last of Argentina’s provinces to reach a deal with its creditors after the nation restructured $65 billion in sovereign bonds almost exactly one year ago.

Buenos Aires’ latest offer is valued at around 51.1 cents on the dollar, including past due interest, according to a report from BancTrust & Co. in Buenos Aires. The exchange offers bondholders new securities maturing in 2037, with coupons that increase to a maximum 6.6% by 2025.

Keine Kommentare:

Kommentar veröffentlichen