Markets

Argentine Warrants More Than Double After Ruling Favors Aurelius

By- U.S. court says Argentina must show how it calculated 2013 GDP

- NY-based fund claims Argentina fudged GDP data to skip payout

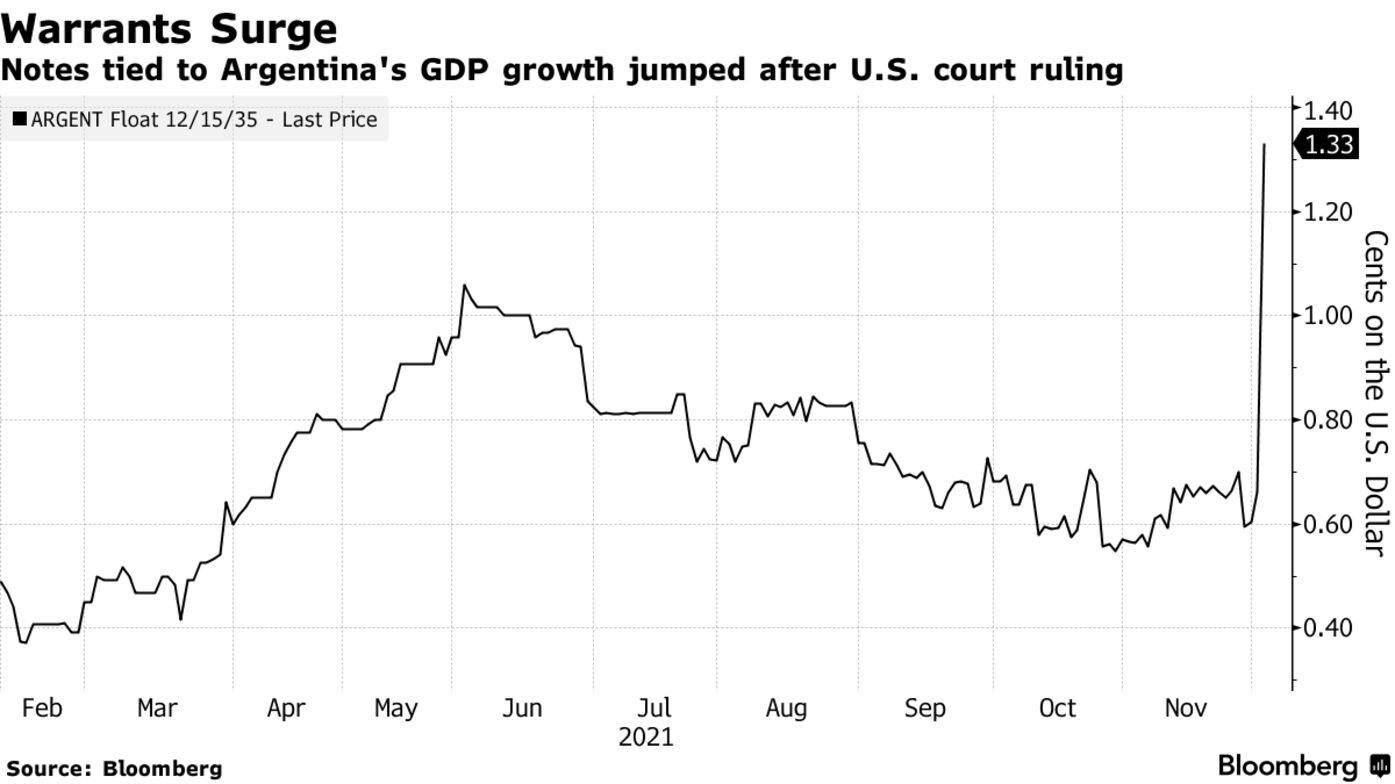

Notes with payouts tied to Argentina’s economic growth surged as much 107% on Thursday after a U.S. court ruled the country will be required to show how it calculated statistics at the center of a legal battle between hedge fund Aurelius Capital Management LP and the South American nation.

Its warrants tied to gross domestic product surged to their highest since March 2020, with dollar-denominated warrants due in 2035 jumping as much as 107%, and euro-denominated securities climbing 42%.

Argentina will need to reveal the methodology it used to measure GDP and economic activity in 2013, according to a ruling from a federal court in New York published on Wednesday. The court will also require Aurelius to hand over documents related to its purchase of the securities at the center of the case.

The New York-based hedge fund claims then-President Cristina Fernandez de Kirchner’s administration misrepresented GDP figures that year to avoid paying holders of the securities billions of dollars they were owed. The warrants, which trigger payouts when specific growth thresholds are met, were offered to creditors in a restructuring after Argentina defaulted on $95 billion of debt in 2001.

The hedge fund alleges that fudged statistics from Kirchner, who is now vice president, prevented the firm from cashing in on a roughly $61 million payout. Argentina has said in court filings that it made all required payments tied to the warrants, totaling nearly $10 billion, and has asked the judge to dismiss the claims. The court denied that request earlier this year.

— With assistance by Bob Van Voris

Keine Kommentare:

Kommentar veröffentlichen